Ethereum might be the hidden gem of this crypto cycle. While Solana has been getting all the attention—with its wild meme coins and crazy trading activity pushing $SOL nearly to its peak—and Bitcoin (almost) hit the exciting $100K mark, Ethereum has been quietly sitting in the background.

Ethereum is supposed to be the best of both worlds: a digital asset you can store value in, and a platform for building cool decentralized apps. But something's been holding it back. Layer 2 solutions like Arbitrum and Base helped Ethereum handle more transactions but also created a bit of a mess. Each of these networks is like a separate island, and it's not easy to move between them.

From my work at Jumper, I know how frustrating this can be. Users get stuck on one chain, making the whole experience clunky compared to how smooth Solana feels. It's like having multiple social media apps where you can't easily share between them.

But here's the good news: Ethereum is working on fixing this. Despite all the negative chatter online, we might see some real improvements in the next year.

Tons of solutions are converging towards realistic and implementable fixes of the fragmented cross-chain landscape. Let me explore that in this little article.

Current cross-chain landscape of fragmentation

The current cross-chain Ethereum landscape is characterized by a combination of

1. large liquidity highways (ETH/USDC → ETH/USDC) and 2. local delivery endpoints to reach long tails assets (first and last mile)

The journey of a cross-chain transaction is materialized in up to 3 interactions:

The first one is “The First Mile” or the swap of your niche token (e.g. ElonRocketOnMars) to USDC or ETH.

Then, the cross-chain transaction is done through the ‘Highway’ using USDC-ETH on both chains.

Then, if you want to go back to a niche token on the destination token, you need to swap back using the destination chain liquidity pool:

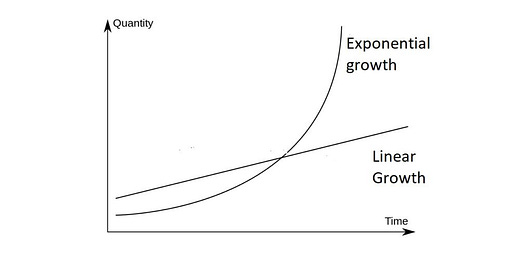

Jumper order flow gives you a good idea of cross-chain transactions being mainly “Highway” transactions:

65% of the total Jumper bridge volume is done with two assets on 6 chains

You can see the prominence of USDC to USDC and ETH-ETH for cross-chain transactions bridges. In the last 30D on Jumper, almost 66% of cross-chain volume have been done through those two assets.

This infrastructure works well in theory but has several big flaws:

Liquidity must be created and maintained in parallel on multiple chains to be used in the cross-chain universe. It is capital and operation-intensive and creates a long-term burden that deters projects to launch on too many chains.

Solver’s role is critical. They’re supposed to ease the routing of whatever wallets to whatever chains, but can they really do that?

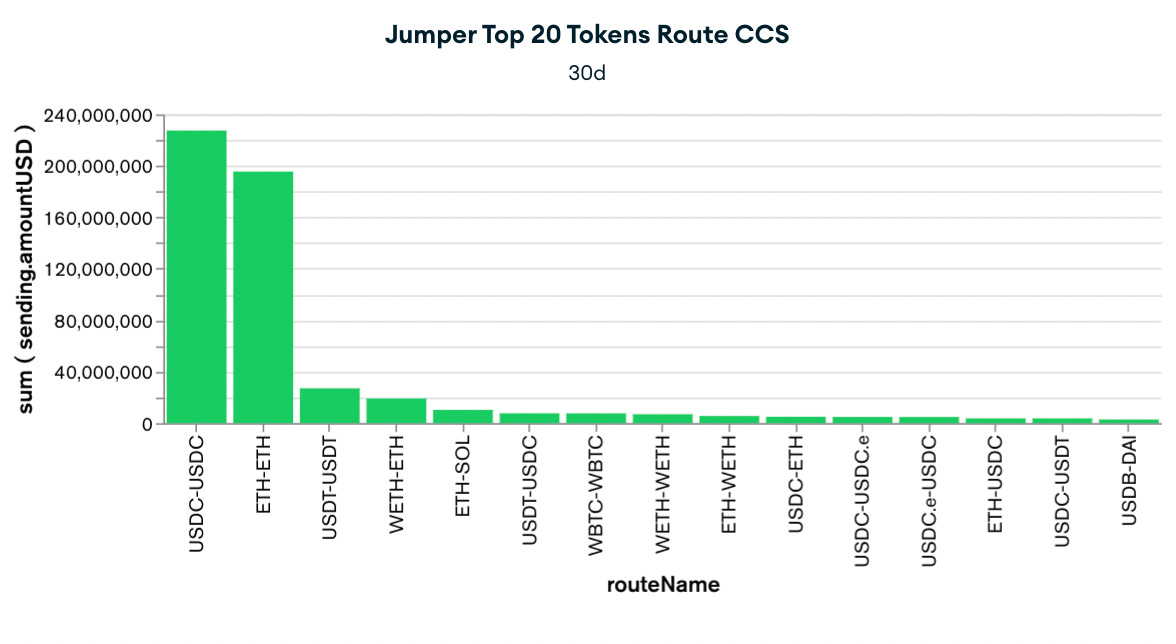

The more chains, the exponentially complex their job is:

In a world of 2 chains and 2 assets on each chain → you need to monitor 6 different routes (4 cross-chain and 2 same-chain)

With 3 chains and 3 assets, it becomes 36 (27 and 9)

With 4 chains and 4 assets, it becomes 88 (64 and 24)

With 5 chains and 5 assets, it becomes (125 and 120)

In general, with Y assets and Y chains, you need to take care of Y^(3) cross-chain routes and Y! same chains routes.

This complexity problem becomes worse and worse with an increasing number of chains. The capital cost of fronting transactions on multiple chains explains why the solver's role has not become prominent so far.

The Promise of Faster Cross-Chain Transactions and the Emergence of unicity

The Emergence (and Proliferation) of Cross-Chain Token Standards

With Layer Zero's OFTs, Wormhole’s NTT, and Axelar’s ITS standard tokens, we are witnessing the rise of a new way to solve the multi-chain conundrum through cross-chain standards.

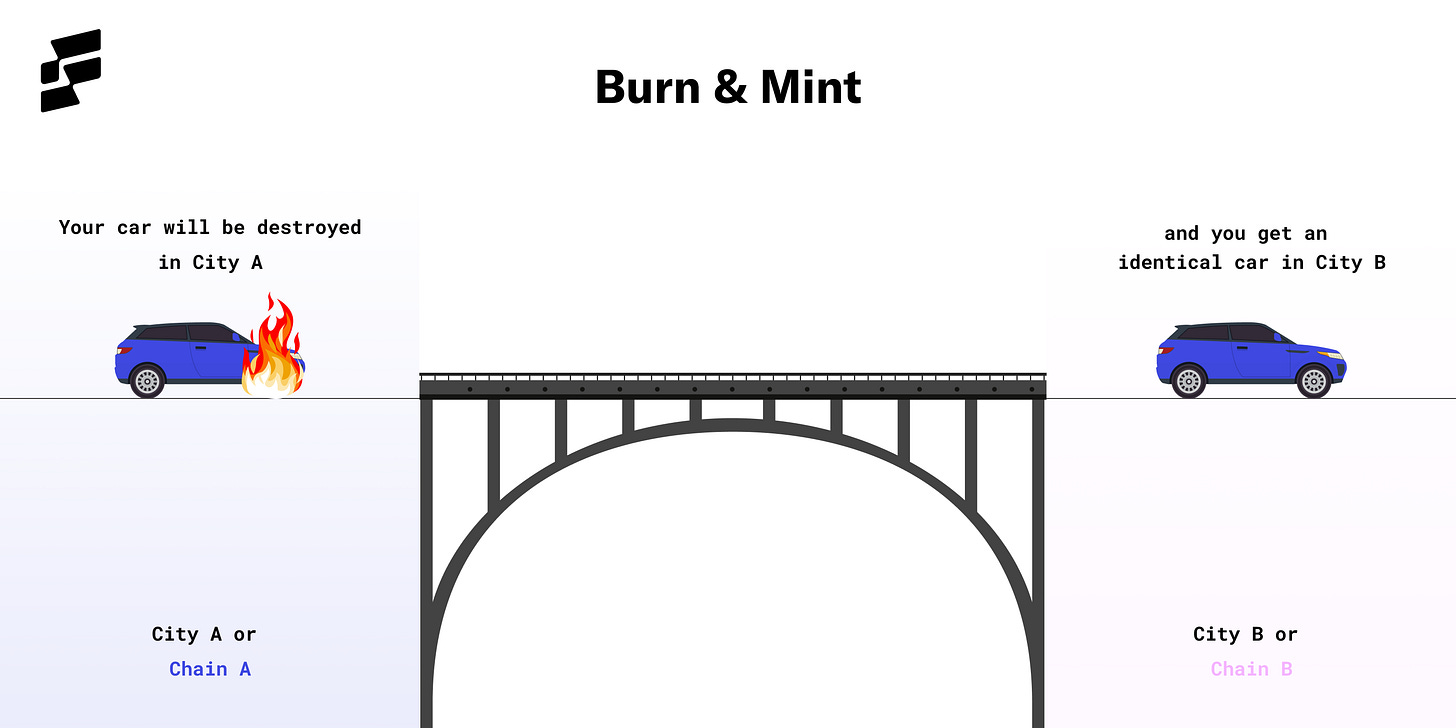

Instead of actually using liquidity pools to get an asset on another chain, those standards consist of burning a token on a source chain and issuing it on the destination chain.

Lock & Mint cross-chain mechanism does not require cross-chain standards but is much more capital intensive.

In theory, this is pretty cool because you don't need to create liquidity on a new chain for a token but can rely on the liquidity on another chain.

The main limit

However, the current implementation faces significant challenges as transaction times are relatively long (around 1 minute).

It still requires solvers to maintain liquidity on multiple chains.

But once the limit is overtaken with sub-5 seconds transactions, a new paradigm could be materialised:

The journey of a cross-chain transaction will be materialized in up to 3 interactions:

Any token could be burnt/minted to a Home chain (1)

There a liquidity transaction would happen to buy any other token (main or niche) (2)

Then the token would be burnt/minted to another chain (3).

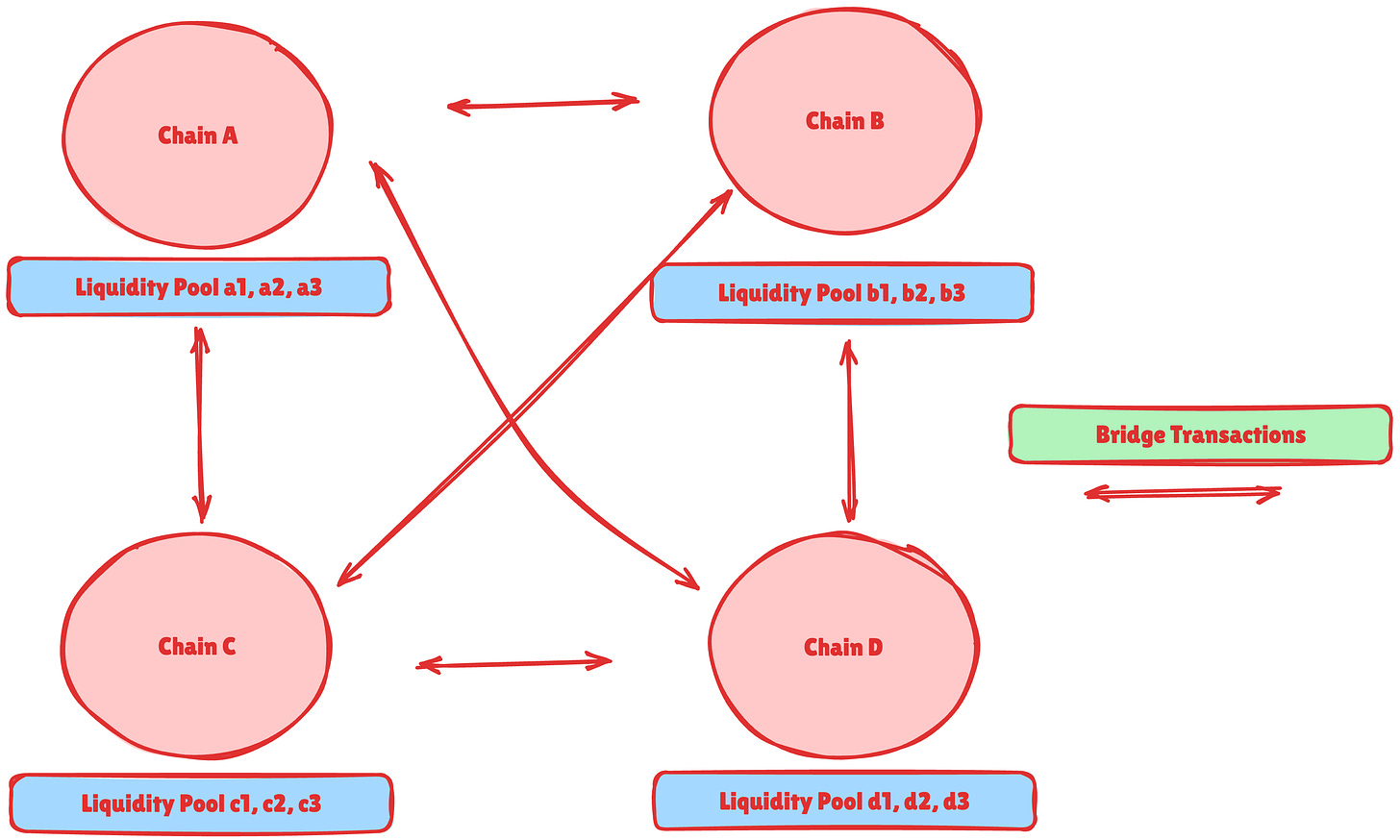

The problem is not exponential anymore but linear, and that makes all the difference.

Adding one more chain only adds one more cross-chain route to focus (chain X <-> Home Chain), and no additional same chain swaps to take care of.

Key Characteristics of the New Cross-Chain Infrastructure relies on three pillars.

Specialised Solver Roles: Specialized swap solvers tied to specific transaction messaging protocols. To be scalable, solvers should focus on Home chains' liquidity, not cross-chain liquidity.

- Diverse Messaging Standards: Coexistence of multiple standards like xERC20, NTT, ITS, Warp, or OFT. Everyone knows the memes around standards, I doubt there will be only one cross-chain token standard, and it would not be good for the reliance on the ecosystem.

- Aggregation Mechanisms: Need for aggregation systems that can integrate various cross-chain communication protocols

Conclusion

The future of cross-chain liquidity is not about eliminating complexity but about managing it more elegantly.

Ethereum will be unified again by focusing on faster cross-chain transactions; liquidity management focused on Home chains and aggregation of token standards.

The path to Ethereum unification comes down to simplifying cross-chain interactions from an exponential problem (i.e. the amount of liquidity paths solvers and bridges have to handle) to a linear problem (home chain with liquidity and token standards).